Investing in giant greenhouses to cut emissions and create jobs

Project brief: build greenhouses the size of 47 football pitches that can increase domestic production of tomatoes by 10%, are heated entirely from a recycled water plant, and also cut GHG emissions by 75%.

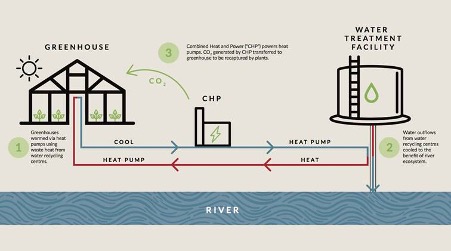

A pipe dream? Well, in some ways. Water-to-water heat pumps linked to nearby wastewater projects mean that water piped into the greenhouses will be 50°C, which can ensure each greenhouse has a constant temperature all year round. The carbon footprint will be cut by three quarters as a result.

Delivering on the dream, however, took a lot of coordination. What Oasthouse Ventures, the company behind the project, needed to find, was large areas of available low-grade agricultural land – in this case, adding up to 290,000 square metres of Norfolk and Suffolk farmland (or 47 international football pitches) – close to a supply of warm water. (The Suffolk site is pictured above)

They also needed investment, which is where the Brunel Pension Partnership came in. Brunel, on behalf of its clients, chose Greencoat Capital’s “GRI” fund for its Secured Income Portfolio, thereby enabling Greencoat to invest £120 million into the construction of these behemoth greenhouses – two near Norwich, one near Bury St. Edmunds.

“We’re very pleased to have achieved another first in the UK renewable energy sector,” said James Samworth, Partner at Greencoat Capital. “Technology and cross-sector co-operation is continuing to unlock some amazing possibilities in energy and agriculture. We see considerable opportunity to invest in renewable heat in the UK, providing pensions investors with the predictable returns they require to pay beneficiaries, meanwhile reducing our carbon emissions as an economy.”

Had it not been for Brunel’s clients, it is unlikely these projects would have happened, given the very tight construction timescales to achieve RHI accreditation.

“Without the scale advantages and coordination LGPS pooling offers, it is unlikely the LGPS would have got involved with this project,” said Richard Fanshawe, Head of Private Markets at Brunel. “The kind of access to private markets our Clients now benefit from by operating as one gives them the opportunity to implement the Partnership’s Responsible Investment principles by investing for a world worth living in whilst also delivering on the Pooling objectives. In this case, they have invested in these world first sustainable UK farming projects, using the largest heat pumps ever deployed in the UK.”

There are other benefits too, among them 137 permanent local jobs in Norfolk and Suffolk, with 117 seasonal worker roles (April to October). Further benefits reduced need to import produce – just 20% of tomatoes consumed in the UK today are homegrown. Using screens reduces the need for pesticide and water usage is severely reduced. Thanks to the circulation of the water, there is no wastage. The end result is a process that is ten times more productive than field farming.

Treated water, warmer greenhouses: The energy loop

There are many ways for investors to help deliver on our climate and social commitments. You might like to see some of the recent ways that we have trying to do just that.