Six Brunel clients are investors via Schroders Greencoat in new UK solar acquisition

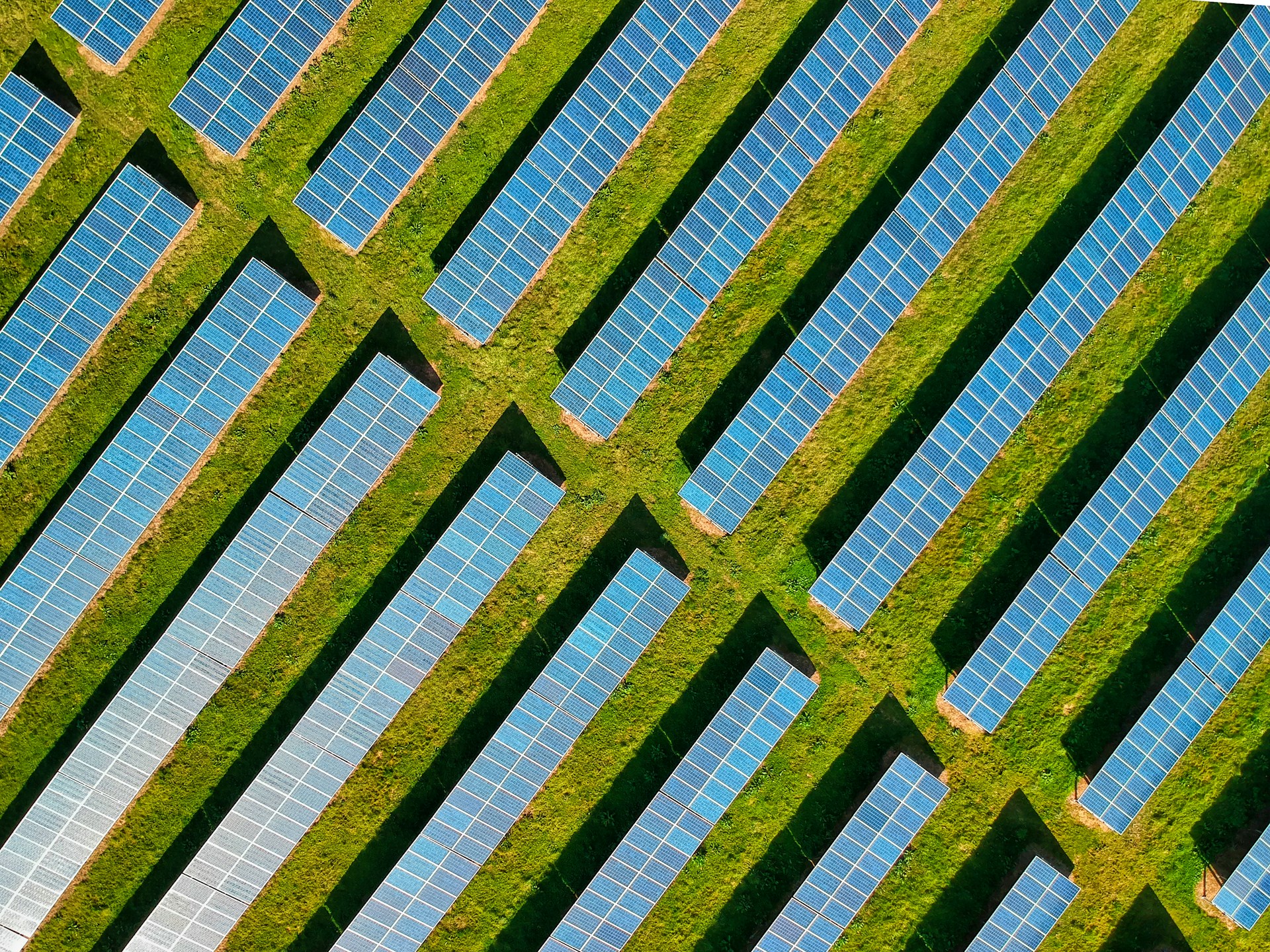

Schroders Greencoat this week announced the acquisition of the c.£700 million Toucan Energy portfolio, the largest operational solar PV portfolio ever traded in the UK.

Six Brunel clients are major investors in the project via the Schroders Greencoat Wessex Gardens fund: Avon, Cornwall, Devon, Gloucestershire, Oxfordshire and Wiltshire. Other Brunel clients are indirect investors via Greencoat Renewable Income.

Wessex Gardens is a place-based and locally-focused renewable energy infrastructure fund that was established in 2023 to invest in projects in the South West of England that have significant climate solution benefits.

Schroders Greencoat

Brunel has built strong links with Schroders Greencoat over the last 5 years, investing its Secured Income Clients as cornerstone first close investors in Greencoat Renewable Income (including in 2 major greenhouse projects in East Anglia), and also through the Cornwall Local Impact portfolio. Both of these funds are investing in the Toucan transaction alongside Wessex Gardens.

“We are thrilled to have agreed to acquire Toucan Energy’s solar portfolio, particularly given the size, complexity and number of stakeholders involved,” said Lee Moscovitch, Partner at Schroders Greencoat. “The transaction would not have been possible without the support from our investors including Brunel and their partner LGPS.”

“Local Government Schemes are an integral part of the institutional investor market in the UK and are becoming increasingly global. Brunel and their partners have led the way in sustainable investment in private markets in the build out of what is now a substantial alternatives platform.

“We are delighted to play a part in delivering reliable returns through innovative investor-led solutions, whilst supporting the UK’s levelling up agenda, and providing a substantial contribution to the UK’s Net Zero strategy.”

You may also like to read coverage of this investment by Schroders Greencoat.