Leveraging the Pool to Build Infrastructure Solutions

From telecoms to transport, highways to hospitals, energy to efficiency, infrastructure investment helps equip society for the future. With global infrastructure requirements estimated to require over $3 trillion a year this type of investment also tends to provide relatively steady and predictable returns lasting years into the future, but only if done sustainably.

Infrastructure is one of six private market portfolios that we offer our Clients at Brunel, and we are keen to develop more direct Infrastructure investment capabilities, including, but not limited to, supporting projects in the UK – a clear objective of LGPS Pooling.

Other clear objectives of pooling are to bring about scale efficiencies to improve fees and terms, and to sustain net return outcomes whilst minimising the risk of over-exposing Clients to any one asset, sector or asset manager.

It is with all of these objectives in mind that we have spent the last year conducting a rigorous selection process for a manager able to set up a discretionary infrastructure vehicle dedicated to our Clients, their strategy and their values.

Pooling for infrastructure

This process has culminated in the appointment of StepStone Infrastructure and Real Assets (SIRA). SIRA are a strong and experienced global team with a highly-specialised knowledge of infrastructure. They are one of most active deployers of primary capital in the world, able to build an infrastructure portfolio designed to Brunel’s exact specifications.

Crucially, SIRA bring a sharp focus on sustainability, in keeping with our broader responsible investment strategy and far superior to other market solutions, which offer only a very standardised ESG approach.

The SIRA solution provides our Clients with a multitude of benefits including:

- A resilient and scalable offering that is amply resourced to cope with multiple investment cycles.

- Direct exposure to underlying assets displaying strong long-term sustainability characteristics.

- Access to direct co-investment opportunities and secondary transactions across a broad range of sectors and on a global level.

- Fee efficiency and cost transparency.

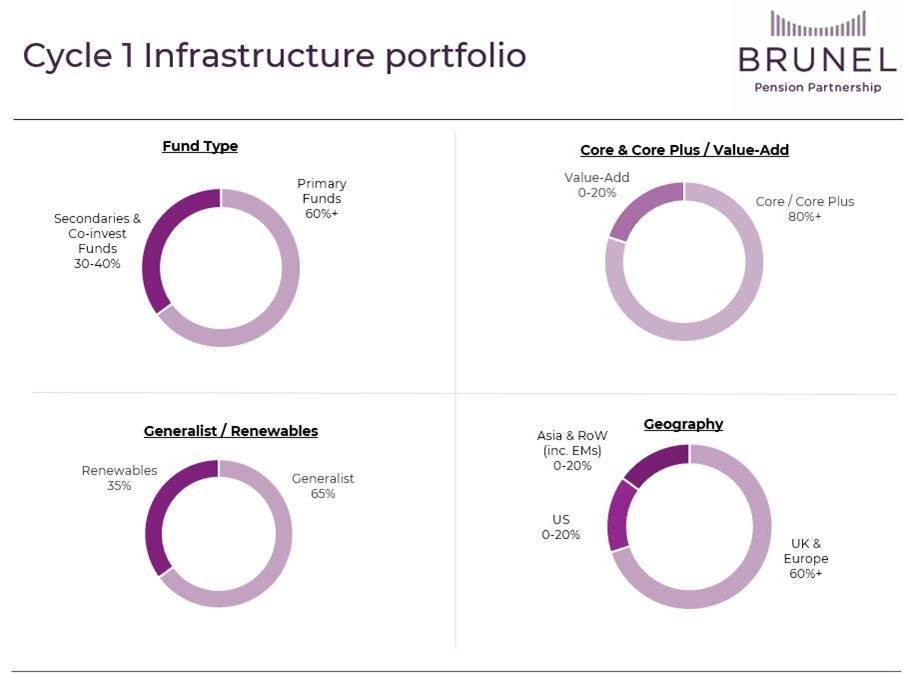

To date we are delighted to have made some investments with SIRA into both renewable energy funds and general infrastructure vehicles which focus on sustainability. These have formed part of our Cycle 1 Brunel Infrastructure portfolio, created in September 2018 to invest in both primary funds and tactical co-investments and secondaries throughout the world, with a bias to the UK and Europe. It aims to secure at least 35% renewable energy exposure.

Looking further into 2020

Infrastructure investments, with their more defensive qualities and combination of capital and income, are an important part of any pensions portfolio, especially so in a year like 2020.

Progress with SIRA has been excellent to date and a clear demonstration of the strategic partnerships that pooling has enabled. We look forward to launching the Cycle 2 Brunel Infrastructure Portfolio in Q2 this year, and a long and productive relationship with StepStone.