Assessing climate alignment for action

In our Climate Change Policy 2023-2030 we set out a process, based on climate alignment that describes our basis for climate engagement and, ultimately, where appropriate, selective divestment. This is a sensitive topic, and a careful balance between transparency, accountability, and regulatory requirements must be found.

Who does our approach apply to?

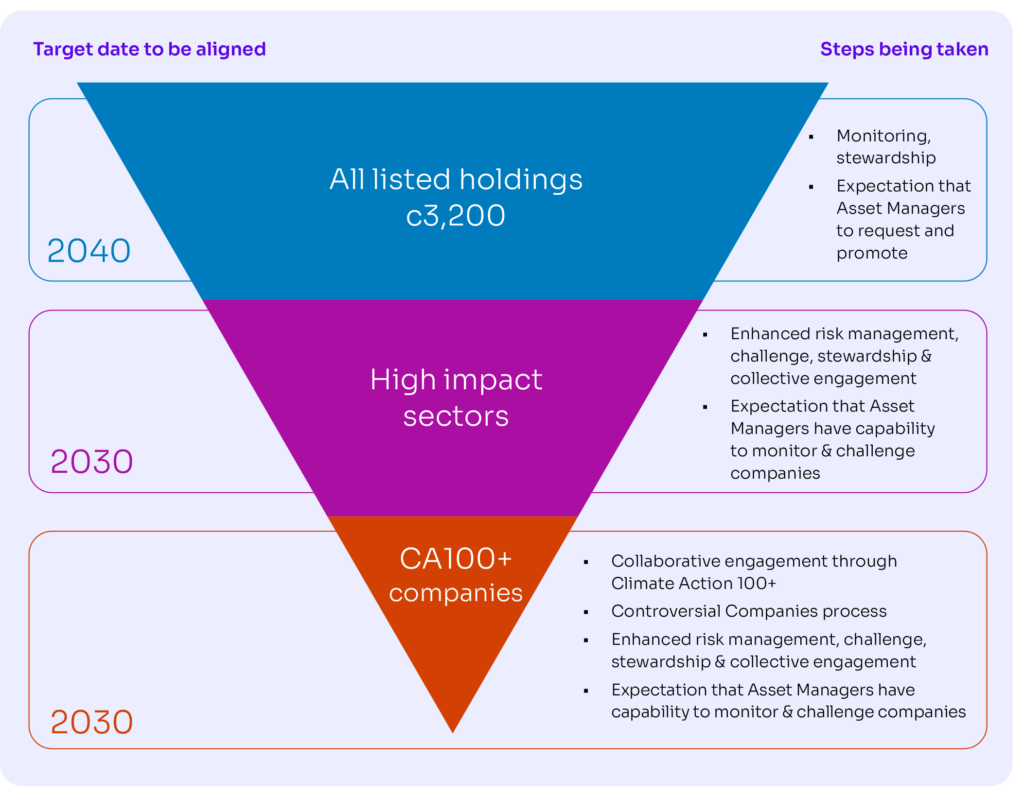

Our Climate Change Policy applies to all of our holdings. Our ‘climate alignment’ criteria detailed below (‘our expectations’), applies to all of our listed holdings, but when we expect them to become ‘climate aligned’ is based on the impact they have on the climate.

Holdings are grouped, based on this impact assessment, into:

- Listed holdings – c 3,200 companies held by Brunel

- High impact sectors – those companies that are part of a specified list of high impact sectors

- Climate Action 100+ companies – 170 organisations, identified by Climate Action 100+ (CA100+), an investor-led initiative, as the world’s largest corporate greenhouse gas emitters

This grouping of our listed holdings is also used to prioritise our engagement activity, and underpins the steps taken to engage with the holdings.

Our expectations

Here we only detail our expectations in relation to climate alignment, which are a subset of the more holistic climate risk assessment and stewardship expectations of holdings. For example, we also expect plans to be held to demonstrate management of physical climate risk and resilience.

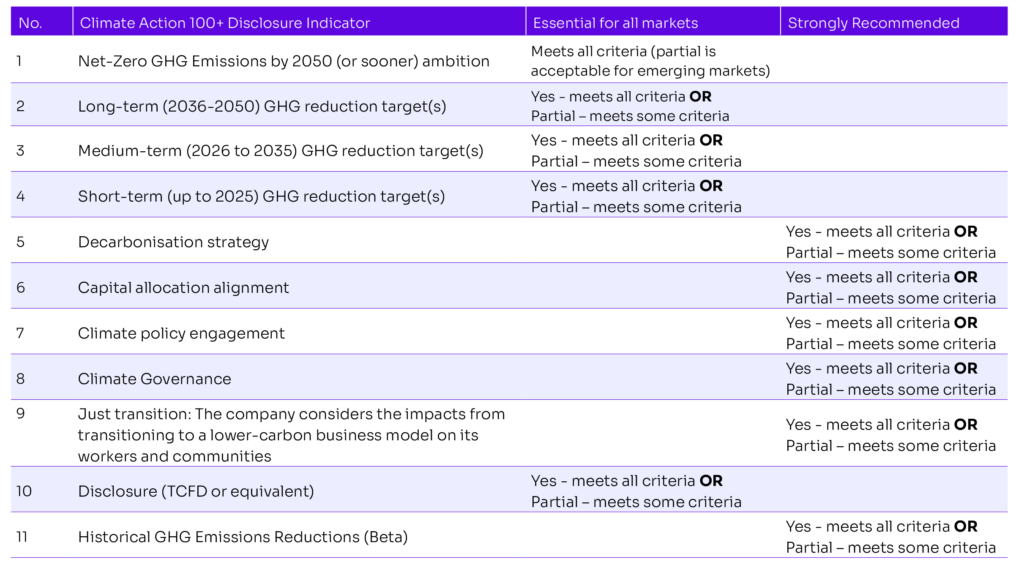

Our expectations use the CA100+ ‘Alignment Maturity’ indicators, and form our minimum requirements of organisations, we of course, encourage companies in all groups to exceed these standards.

Any companies held by Brunel, who are unable to comply with criteria, either through the benchmark or in the provision of credible evidence, will be subject to challenge via the asset manager and selective divestment within 12 months of the reassessment date.

If the company is not held by Brunel, our Asset Managers will be instructed not to invest in that company in the future, unless the company improves.

Summary of Alignment Maturity Expectations for 2024/2025

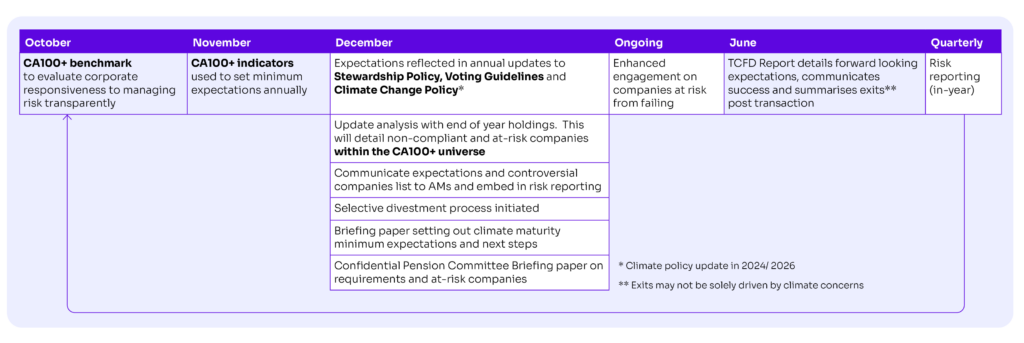

Reviewing the criteria – an annual process

We are committed to reviewing our criteria, the timelines and the efforts of Asset Managers (AMs) / companies to meet these expectations annually. This is to ensure we keep pace with the rapid market, scientific, technological and policy developments and context. The expectation was set that the minimum requirements would get more stringent over time.

Our annual timeline for review