Brunel Governance

We have a board of eight directors, comprising three executives and four non-executives, as well as a non-executive chair. Members of the Board can be identified in the People section.

What we spend and how we spend it

Our annual budget is funded by our shareholders. We are non-profit making and any surplus generated in a financial year is either returned to shareholders or retained by agreement in order to meet future expenditure.

We are subject to the Public Contracts Regulations (PCR) and comply with PCR when we enter into contracts, if applicable. For a current list of open procurements with Brunel, please visit the UK government’s Contracts Finder website.

What our priorities are and how we are doing

The government’s core objective in setting up LGPS pools was to reduce costs. We deliver value for money for our clients through a number of ways, including economies of scale, saving money on duplication of due diligence, operational due diligence, legal and tax advice, as well as benefitting from the combined expertise of the Brunel team.

Our original business case targeted savings of £27.8 million annually versus the pre-pooling world. By 2021-2, we were already saving over £34 million each year net of pooling costs. Thus, two years ahead of schedule, we were saving around four times the costs we incurred via the management fees we negotiated.

Since inception, we have also prioritised Responsible Investment, and it runs through everything we do at Brunel.

How we make decisions

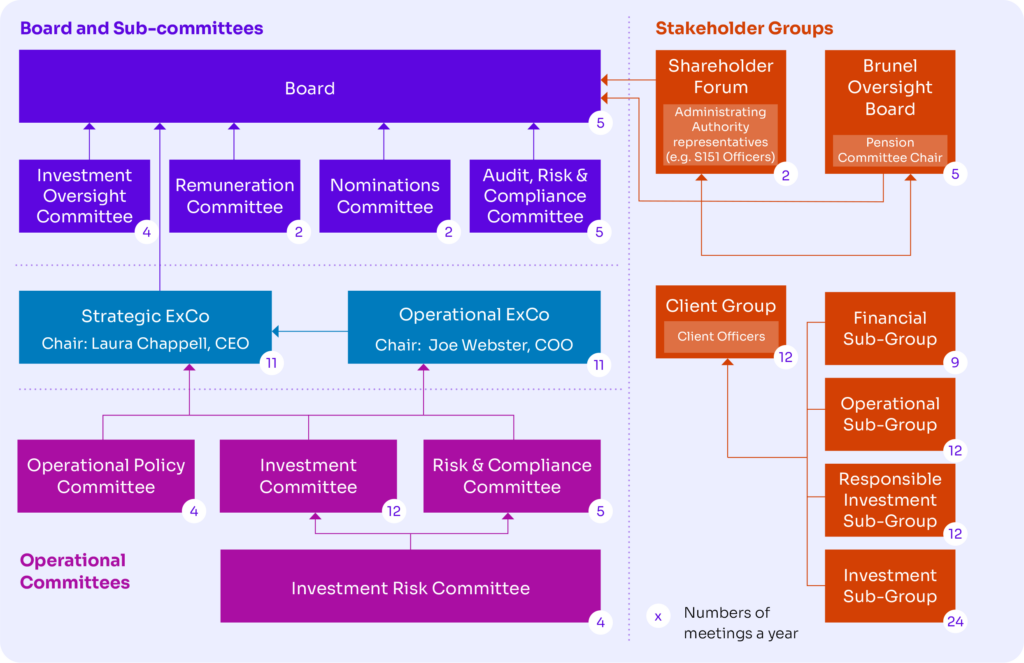

The Board makes most day-to-day decisions affecting Brunel. However, certain decisions have been reserved to our shareholders, meaning their prior approval is required ahead of implementation.

More broadly, Brunel’s activities are subject to scrutiny by the Brunel Oversight Board (BOB), which comprises representatives of our clients, typically members of their respective Pensions Committees. Although not a decision-making forum, BOB provides considered and informed oversight. In addition, our Client Group (CG), comprising officers from our clients’ pension funds, provide BOB with advice on pensions and investment matters.

The services we offer

We act as the discretionary investment manager of our ten clients in accordance with our duties and obligations under applicable regulations. We do not act for any client that is not the administering authority of a UK local government pension scheme and are unable to offer services to any person that is not a professional investor (as defined in the FCA Handbook).

Under applicable regulations, each of our clients retains responsibility for how they allocate assets within the LGPS pension funds that they administer. Once they have made their allocations, we offer them a broad range of portfolio options, with the aim of allowing them the flexibility to meet their own investment strategy needs, whilst equipping us to manage risk and generate sustainable, long-term returns. These options currently comprise 24 portfolios across three strategies, namely active equities, passive equities and private markets.

We deliver these strategies in the following ways:

- Active equity strategy – this is delivered through the TM Brunel Pension Partnership Authorised Contractual Scheme (ACS), which is a form of collective investment scheme approved by the FCA. The ACS is operated for regulatory purposes by Tutman. Tutman have appointed Brunel to act as the investment manager of the ACS and Brunel, in turn, appoints sub-investment managers or invests in regulated collective funds in respect of each sub-fund. The ACS was launched in 2018 and currently offers Clients seven portfolios:

- UK Equity

- Low Volatility Global Equity

- Emerging Markets Equity

- High Alpha Global Equity

- Diversifying Returns

- Smaller Companies Equities

- Global Sustainable Equity

The ACS prospectus is available on request – please email Tutman, our ACS manager, at info@tutman.co.uk .

- Passive equity strategy – this is delivered through the appointment of Legal & General Investment Management (LGIM) on behalf of our Clients. LGIM are a leading investment management company and were appointed in 2018 as a result of a procurement exercise through the National LGPS Framework operated by Norfolk County Council.

- Private markets – this is delivered through the selection of leading private markets fund managers on behalf of our Clients. Our Clients then directly invest with the selected fund manager.

Our information

Our information, how it is managed, and what we do with it, is covered by our Scheme of Publication.

Our policies and procedures can be viewed in the Library section of our website.